Quick Start Guide

Start earning money with Lendr in less than 5 minutes with our short video guides:

Step 1

Opening a Trove

To start using the network, you will need to obtain Lendr stablecoins by opening a trove.

Step 2

Stake Lendr Stablecoins

You can earn rewards and contibute to the network’s stability by staking your Lendr stablecoins.

Step 3

Stake Lendr Reward Tokens

You can earn reward from various network fees by staking Lendr reward tokens.

Step 4

Liquidations (Optional)

The Lendr liquidation system rids the network of undercollateralized loans while also rewarding users.

Step 5

Redemptions (Optional)

The Lendr redemption system allows users to swap Lendr stablecoins and collateral at a 1:1 ratio at any time. Users can earn profits when arbitrage opportunities arise using redemptions.

Step 6

LP Token Staking (Optional)

The Lendr LP Token staking system rewards users for creating liquidity for Lendr stablecoins. Click the link to view a short guide on creating V2 LP tokens that is simple enough for beginners.

To learn more please visit our Youtube Channel to watch the Lendr Network FAQ Series or read our Documentation.

Quick Start Guide

Lendr Network is a decentralized lending protocol allowing users to obtain 0% interest loans on stablecoins pegged to real-world assets.

The Lendr Network offers various ways for users to earn rewards for participating in the protocol. Here is a short guide on how to start earning rewards on Lendr:

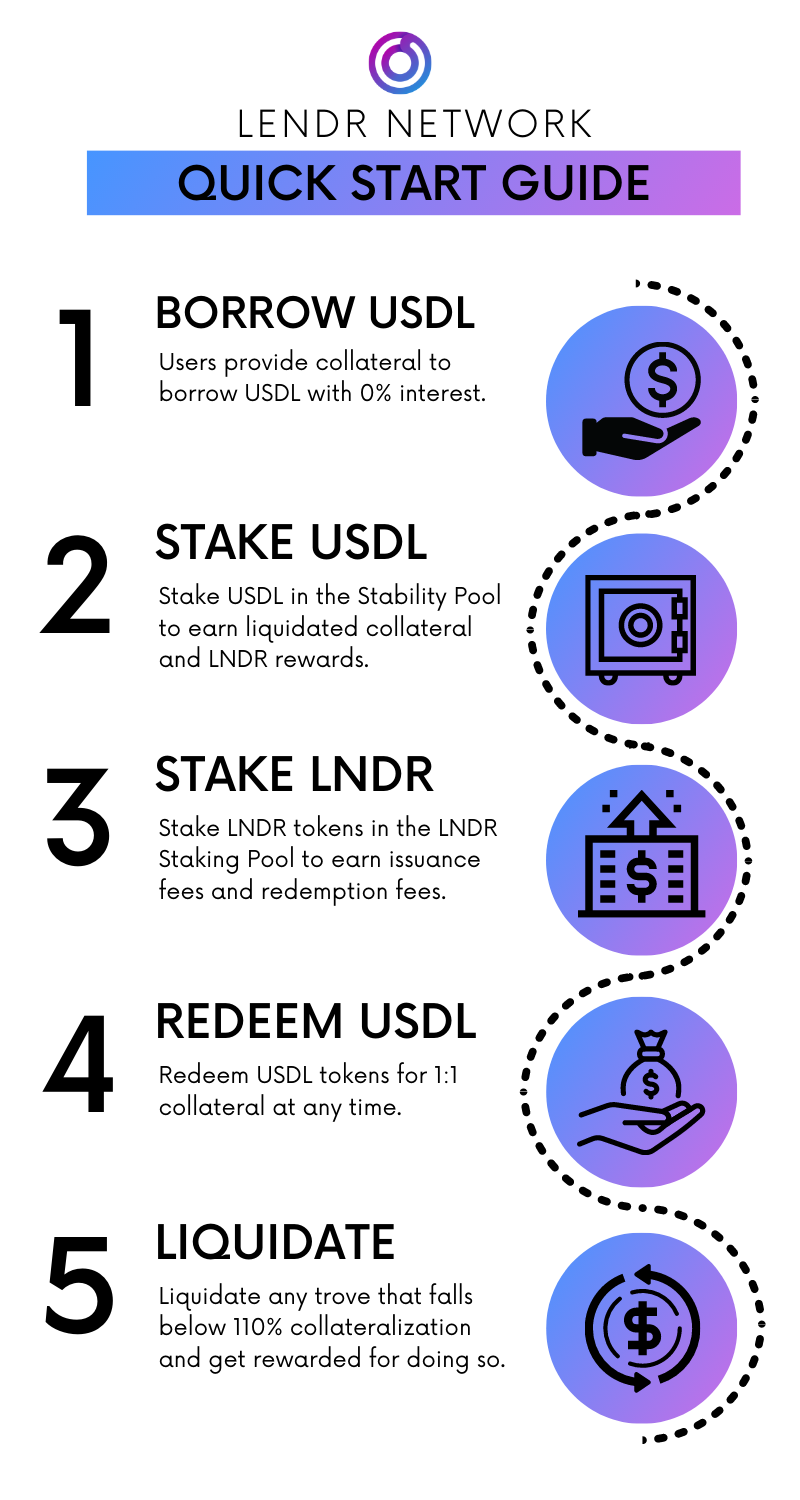

On the Lendr app you can provide collateral to take out an interest-free USDL loan to get started.

From there, you can stake your USDL in the Stability Pool to earn rewards.

By staking USDL you earn liquidation gains (in BNB) and the Lendr token (LNDR).

LNDR receives issuance and redemption fees from users.

To learn more about USDL staking click here.

The redemption system allows anyone at anytime to exchange USDL for 1:1 backing (BNB) at the target price.

This is crucial for maintaining the price peg.

Learn more about redemptions here.

- Users can buy Lendr stablecoins at the market price, and redeem them for BNB to earn a profit and bring the price up.

- Users can borrow and sell their Lendr stablecoins to make a profit and bring the price down.

*BSC Testnet

FAQ

- What is the Lendr Network?

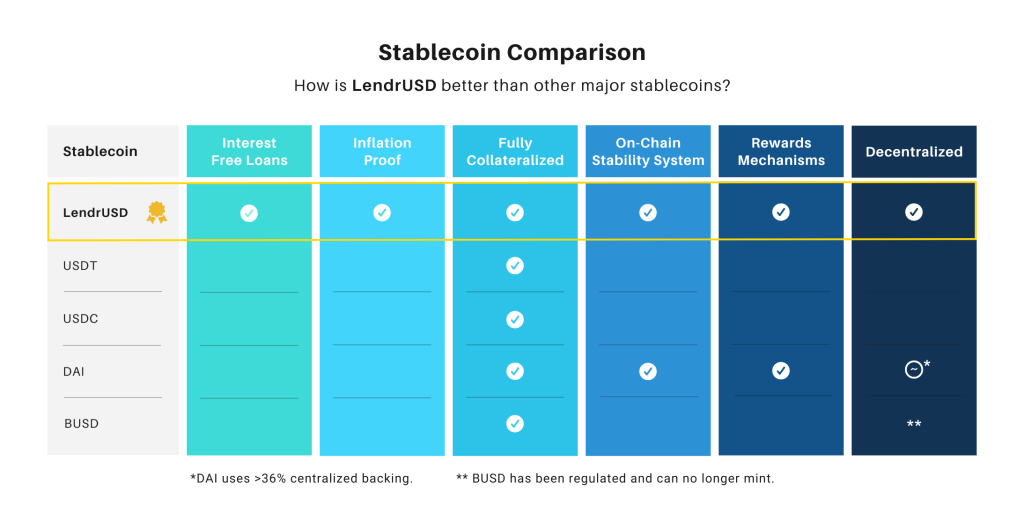

Lendr is an interest-free borrowing protocol that offers an inflation-proof stablecoin (USDL) and will be bringing Real World Assets (RWAs) on-chain as flatcoins.

- USDL is an inflation-proof stablecoin pegged to the U.S. inflation index.

- We offer 0% interest loans to issue USDL using BNB as collateral (110%+).

- Users can stake USDL to earn financial rewards and help maintain the token’s stability/peg.

- Learn more about these systems here.

- Lendr is fully decentralized, governance-free, and self-sustaining.

We are an improved/enhanced fork of the incredibly successful Liquity Protocol (LUSD and LQTY). Learn more here.

- What is Lendr's use case and main features?

Lendr is a lending platform with innovative features such as:

- 0% Interest Rate Defi Loans

- Inflation-Proof Stablecoin (Flatcoin)

- Leveraged BNB positions (up to 11x)

- Token Stability Rewards System – Users are financially incentivized to keep the token peg

- Earn rewards – Stakers receive rewards from the platform

- Decentralized and Governance-Free – Censorship and regulation resistant

- Fully Redeemable – USDL can be redeemed for 1:1 BNB backing at any time by anyone

- On-chain tokens pegged to real world assets (gold, real estate, etc.)

Lendr also has security features such as being 110%+ over-collateralized, and a built in recovery mode.

- How can I earn rewards with Lendr?

There are four ways to make money with Lendr:

-

Deposit USDL – into the stability pool and earn liquidation gains (BNB) and LNDR rewards

Stake LNDR – and earn the revenue from issuance fees and redemption fees

Liquidate Troves – under 110% collateralization for a reward and gas coverage

Stabilize Inflation Price – earn rewards by keeping the token peg through redemptions and issuance arbitrage.

Follow our Quick Start Guide to get started.

- How does LNDR token work with LendrUSD?

LNDR received rewards from the LendrUSD ecosystem.

- LNDR pool stakers collect the fees generated by the LendrUSD system

- USDL Stability Pool stakers are rewarded in LNDR and BNB

Learn more about the LNDR Pool here.

- What early adopter incentives/rewards exist?

- LendrUSD is offering over $150,000 USD worth of early adopter rewards!

- USDL stakers will receive increased LNDR rewards at launch to encourage early adoption.

- Over 500,000 LNDR tokens are included in this reward pool (>$150,000 USD worth).

- Is LendrUSD similar to Terra/Luna (UST)?

Absolutely NOT! Terra/Luna was an algorithmic stablecoin that was under-collateralized and had critical design flaws.

- LendrUSD is NOT an algorithmic stablecoin.

- LendrUSD is fully backed and maintains 110%+ verifiable on-chain collateral.

- LendrUSD is designed to handle bank runs or price drops if they ever occur.

- How does LendrUSD support charitable causes?

- The LendrUSD protocol team has been involved in contributing over $134,749 USD to charitable/social causes around the world!

- Some organizations we have worked with are #TeamSeas, International Animal Rescue, Mental Health America, Wildlife SOS and more.

- 0.5% of the total supply of LendrUSD is staked and used to generate funds to be used for social impact causes.

Click here to learn more.

- What is the long term vision for Lendr?

Our long-term vision for Lendr is to provide a number of decentralized “flatcoin” assets pegged to different commodity indexes such as:

- Gold (LendrGOLD)

- Real Estate (LendrRE)

- Healthcare (LendrHC)

- Oil/Gas (LendrOIL)

Learn more from our documentation here.

-What is the Unipool?

The Unipool is a staking pool smart contract where you can stake Uniswap v2 USDL/BNB LP tokens and be rewarded with LNDR tokens. Learn more here.